Access Bank has been in the news since last week over issues concerning the stamp duty deductions imposed on customers’ accounts.

Many of the bank’s customers have trooped to social media to protest the lofty stamp duty charges withdrawn from their accounts.

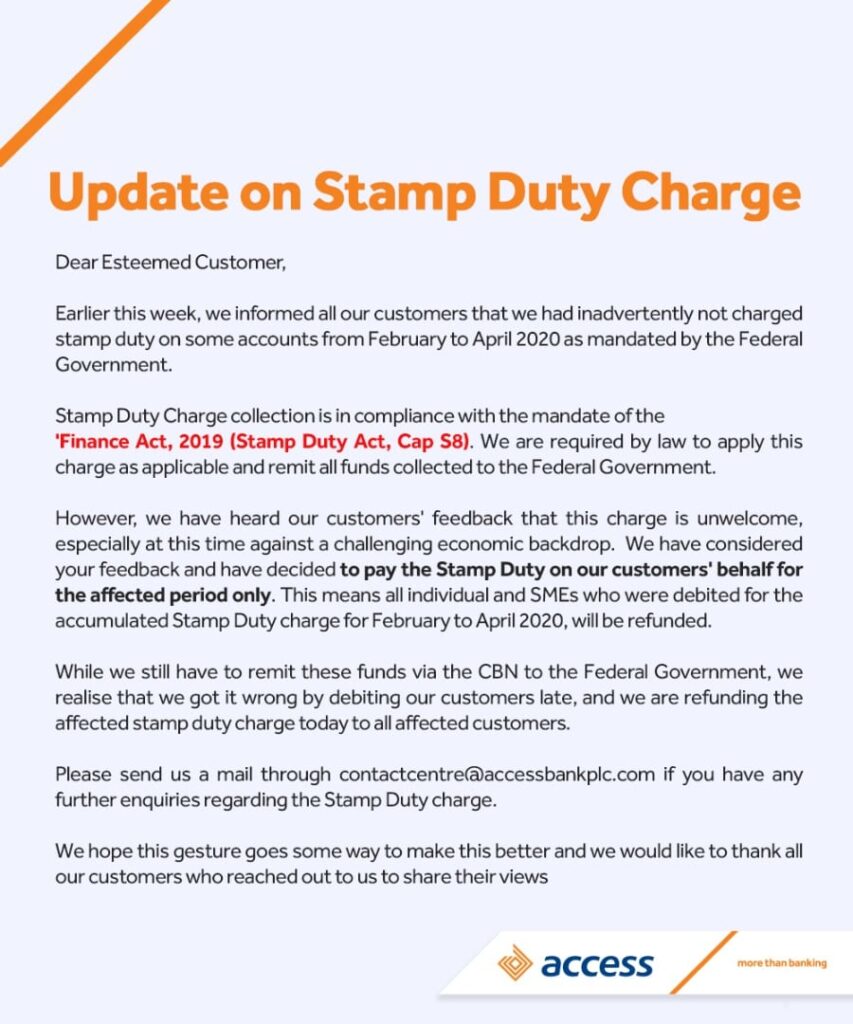

Access Bank in a new update concerning the issue has promised to refund customers the money deducted from their accounts, stating they will pay off the stamp duty charges on their customer’s behalf.

The bank explained they will only take the responsibility of paying the customers’ stamp duty charges for only the period affected.

Access Bank in an earlier response had explained that the stamp duty charges were high because they were accumulated. Access Bank said that they discovered customers were not charged the stamp duty applicable to them between the months of February and April 2020.

This has led to the bank deducting the accrued charges from the customers’ accounts. The bank further explained that the stamp duty charge was mandated by the Central Bank of Nigeria. Both savings and current account holders are required to be charged a N50 duty for transactions (both deposits and electronic transfers) exceeding N10, 000.

Despite the bank’s explanation, the matter continued to create uproar on social media with many of the bank’s customers threatening to close their accounts with the bank.

Access Bank in a new update concerning the issue has promised to pay off the accrued stamp duty charges on their customer’s behalf, for the affected period.

The bank said it will refund customers the deductions that were already made.